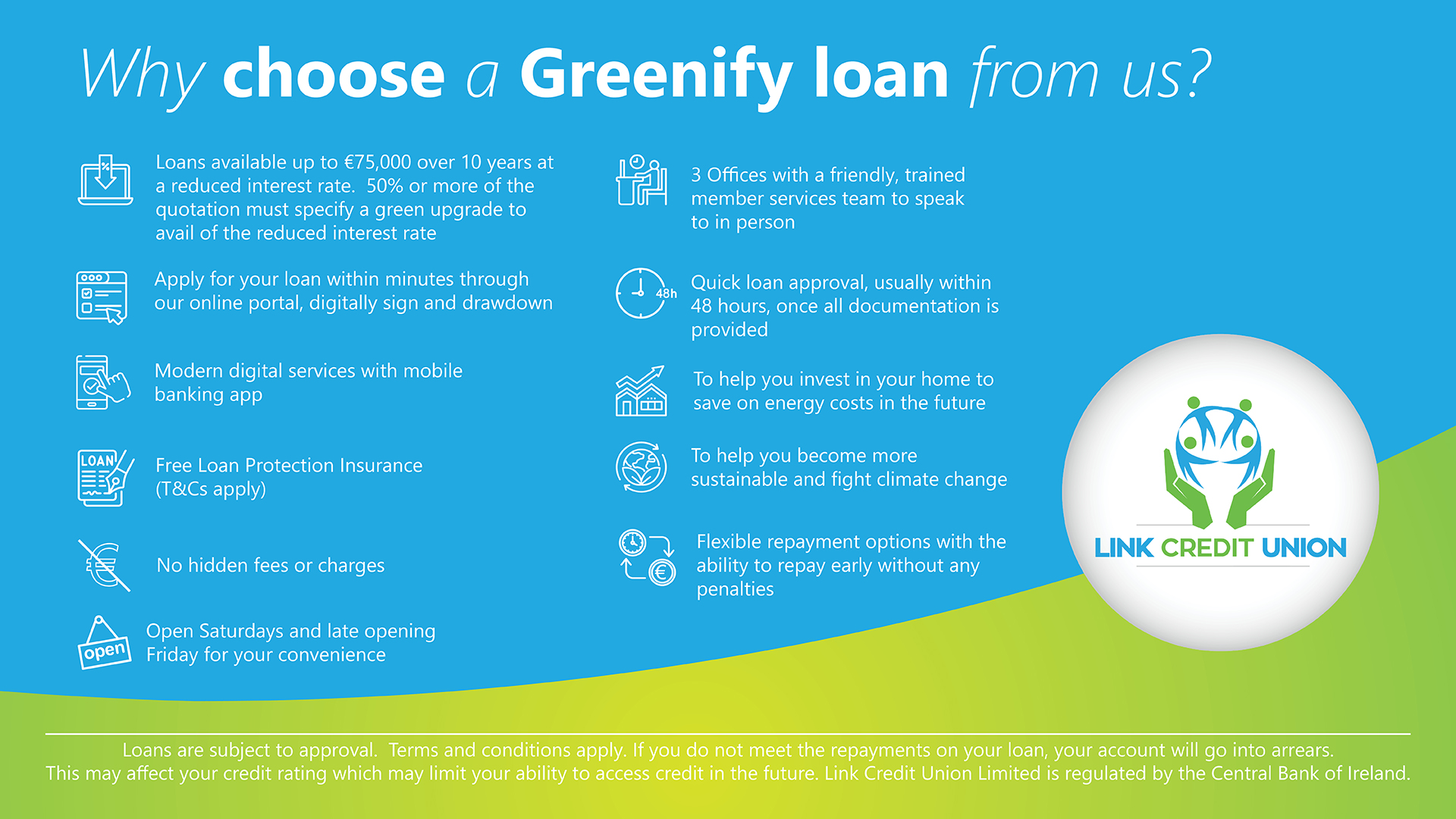

Greenify is a green home energy upgrade loan brought to you by Link Credit Union to finance your home energy upgrades, making homes around the country more energy efficient, more fuel efficient and greener! Our reduced rate Greenify Home loan makes going sustainable a little easier.

Want to learn more about retrofitting and how best to get the most out of the process? Download our Greenify Guide here.

Are you interested in a Greenify Loan but have some questions?

Simply fill out the below contact form and a member of our team will get in touch.