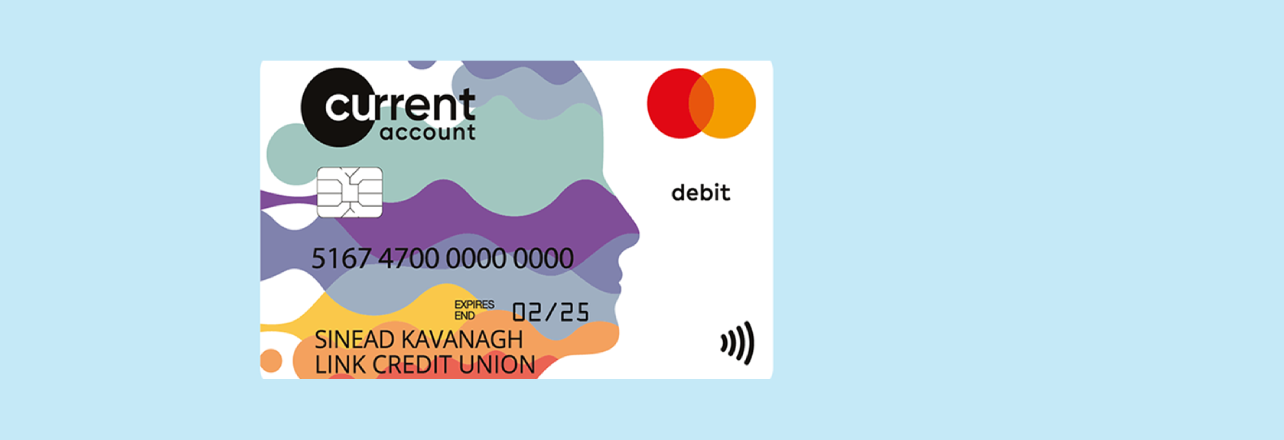

Finally, a real choice! A Credit Union Current Account with a globally accepted Mastercard® debit card.

Apple, Google Pay and Google Wallet are available for easy contactless payments in-store and online.

If you are a member over 16 years of age you can apply now by logging on to our online banking portal below.

- Apple, Google Pay and Google Wallet

- Globally accepted Mastercard® debit card.

- Contactless payments with cashback at participating retailers.

- Low maintenance fee of €4 a month.

- 24/7 access to your account with our online services and mobile app.